August 15, 2016 - At the July 18, 2016 regular board meeting, the Joaquin ISD Board of Trustees approved a Maintenance & Operations (M&O) tax rate that is above the maximum rate allowed without voter approval and they called a Tax Ratification Election (TRE) for Tuesday, August 30th, 2016.

- What is a TRE? When a district adopts a tax rate above its maximum M&O tax rate it much hold a Tax Ratification Election (TRE) to provide voters the ability to ratify the higher rate.

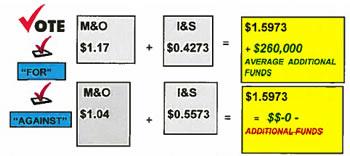

- What is M&O and I&S? The total tax rate consist of two components. The Maintenance & Operations (M&O) portion is for funding the day-to-day operations of the district and the Interest & Sinking (I&S) portion to for paying debt on the school buildings.

- What is a Penny Swap? Passing a TRE with a restructure in the total tax rate, raising the M&O portion of the tax rate by $0.13 and lowering the I&S portion of the tax rate by $0.13.

- Average of $260,000 additional Annual Funding for JISD Maintenance & Operations generated by voters approving a penny swap in a Tax Ratification Election (TRE). (with no additional cost to the taxpayers)

- 2016 Adopted Tax Rate - $1.5973 -- "For" or "Against"

If a majority votes for the $1.7273 tax rate adopted by the Board of Trustees, the tax rate will be $1.5973, because the Board already took action to reduce the I&S rate by $0.13, (from $0.5583 to $0.4273), if voters approve the $1.7273 tax rate.

If a majority votes against the $1.7273 tax rate, the tax rate will be rolled back to $1.5973, and the district will not have access to an average of $260,000 additional funds annually!!

- No matter the outcome of the election - Total 2016 Tax Rate remains at $1.5973

- Comparison to last years rate - The 2015 total rate was $1.5597, or $0.0376 less than 2016 rate. The I&S portion of the tax rate has increased from last year because of a decline in mineral values.

- Taxpayers' Age 65 &/or Disabled - Tax bills are frozen on these homesteads and will never go up unless there are improvements to the property.

Public Presentation Dates:

Joaquin High School Gym on Tuesday, August 16, 2016 at 6pm

Joaquin Elementary School Library on Thursday, August 18, 2016 at 4:30pm

Attendees will have opportunity to ask questions after the presentations.

Early Voting Dates:

Joaquin ISD Administration Office, Monday, August 15 to Friday, August 26.

Special Event Early Voting:

Joaquin High School Gym Foyer on Tuesday, August 16, 2016 at 6:30 to 8:30pm

Joaquin Elementary School Library on Thursday, August 18, 2016 at 5 to 7pm

The wording on the ballot for the Tax Ratification Election is prescribed by law. The ballot reads:

For or Against "Approving the ad valorem tax rate of $1.7273 per $100 valuation in the Joaquin ISD for the current year, a rate that is $0.13 higher per $100 valuation that the rollback tax rate."

Why does the ballot show a tax rate of $1.7273 when everything else says the tax rate will be $1.5973?

Law requires the ballot to read as written above. The ballot shows a total tax rate of $1.7273, which is an increase of $0.13 in the M&O tax rate. The Board of Trustees already took action on July 15th to lower the I&S rate by $0.13 cents to offset the increase in the M&O rate.

The attached bulletin has been prepared by the Joaquin ISD. It is factual and is intended to inform the voters of Joaquin ISD about the upcoming election. All eligible registered voters are encouraged to become informed and exercise their right to vote in this important election.

The attached bulletin has been prepared by the Joaquin ISD. It is factual and is intended to inform the voters of Joaquin ISD about the upcoming election. All eligible registered voters are encouraged to become informed and exercise their right to vote in this important election.