News

March 5, 2026 - On Friday, March 6, 2026 Church Street between Tenaha Street and Porter Street will be closed to finish up repairs on sewer line. Please remove all vehicles from street and use caution in this area.

March 4, 2026 - On Thursday, March 5, 2026, Church Street between Tenaha Street and Porter Street will be closed to make repairs on a sewer line. Please use caution around this area.

March 4, 2026 - The county burn ban, put in place February 25, 2026, was ratified during the Wednesday, March 4, 2026, meeting if the Shelby County Commissioners' Court.

During discussion it was agreed by the commissioners that conditions remain necessary for the ban to remain in place, and that they would revisit the issue again at the next meeting on Wednesday, March 11, 2026.

Judge Harbison commented on the deficient weather outlook for the coming week.

"If you notice our rain chances have went down every day. Saturday's the only day we're having anything over 10%," said Judge Harbison.

Commissioner Tom Bellmyer moved to ratify the burn ban to keep it in effect, Commissioner Shannon Metcalf seconded the motion and it carried with all in favor.

An executive session was held during the meeting from 9:50am until 11:09am and those whose presence was required of the commissioners included John Price, County Attorney; John Pope, Constable Precinct 5; Rowdy Green; and LeAnn K. Rafferty, 123rd Judicial District Judge.

After the commissioners returned to open session, it was revealed that Rowdy Green would be appointed to the position of Precinct 4 Constable recently vacated by Taylor Fanguy on February 7, 2026.

Commissioner Bellmyer moved for Green to be appointed Precinct 4 Constable and for him to be sworn in during the March 11, 2026, Commissioners' Court Meeting. Commissioner Roscoe McSwain seconded the motion and it carried with all in favor.

It was also announced that John Pope, Precinct 5 Constable, will now have a deputy constable and he was given permission to hire the individual, who was not named during the meeting.

Commissioner Bellmyer announced that the commissioners reviewed and approved Pope's deputy position candidate during executive session.

"I think you're wanting to put him in employment starting Monday," Said Commissioner Bellmyer.

He then reiterated to Pope that his deputy nominee was approved.

Constable Pope agreed that hopefully he would have him working by then, depending on TCOLE.

County Attorney Price indicated that a motion was not required regarding the deputy constable position.

The details of Judge Rafferty's meeting with the commissioners wasn't publicly shared at the time of the meeting.

Representatives of the American Red Cross were present during the meeting as the commissioners considered a proclamation to declare March as American Red Cross Month.

"I'm Kimberly Cline, executive director for our Southeast Deep East Chapter, which we cover 17 counties. You guys are our most northern county that we cover and we go all the way down to the coast in our Texas Gulf Coast region," said Cline. "I do very much appreciate you putting this proclamation to be signed because it gives our volunteers the honor, recognition that they deserve for their selfless giving every day."

Cline stated that the American Red Cross responds to a disaster every eight minutes on the national level and she said that is accomplished in part through the Neighbors Helping Neighbors volunteer program.

"We thank you guys for such an amazing partnership and everything. You know this last winter weather really proved a lot, and this community I'm so thankful for because it came together very quickly, overnight actually."

Cline was accompanied by two volunteers including Bob Walsh who shared that he has been volunteering since 2017 with the American Red Cross and Corliss Bonner, a volunteer since 2025, also of Nacogdoches.

The commissioners approved the proclamation with first a motion by Commissioner Bellmyer to declare March American Red Cross Month and a second by Commissioner McSwain. The motion carried with all in favor.

Casey Anderson, Shelby County Commissioner's Secretary, explained to the court about designating Deep East Texas Council Of Governments (DETCOG), on behalf of Shelby County, to verify addresses online for 911 addressing.

"DETCOG has basically come up with two different resources, the first one, is an address verification letter which has to be voted on by the board," said Anderson. "The other one is where they can actually go online, put the coordinates in and send me a request for an address. So nothing's really going to change. It's just going to give people another option."

Commissioner McSwain moved to designate DETCOG, on behalf of Shelby County, to verify addresses online. Commissioner Shannon Metcalf seconded the motion and it carried.

The commissioners considered allowing TxDOT to close a section of FM 139 in Paul's Creek to replace an existing bridge.

"This is a troublesome close because [FM] 139 is a well-traveled road it gets the people on the Joaquin side to the Huxley side and it gets the people from the Huxley side to the Joaquin side," said Judge Harbison.

Judge Harbison commented that if TxDOT totally closes that bridge, the school bus from Joaquin will have to go 23 miles out of the way to carry kids home and the same for Shelbyville if they have to travel through that area with students. According to Judge Harbison, the project isn't scheduled until 2029.

"I don't know that we approve this closure right now, I think we need more discussion and if TxDOT doesn't agree we'll probably have to get the schools involved," said Judge Harbison.

Commissioner Metcalf moved to not close the road, which was followed by a second from Commissioner Stevie Smith. The motion carried with all in favor.

Establishing the value of TxDOT surplus riprap contributed to all precincts of the County was discussed by the commissioners and Judge Harbison sought further clarification on the item.

"About a year ago when when Casey [Anderson] and I were working on some of my FEMA activity, I had a quite a bit of riprap that I used on one of my projects that had been donated and I got approval it was a donation," said Commissioner Bellmyer. "I tried to apply for it, and FEMA denied me because the commissioner's court had never established a value of a donation. I reached out to Jim Allison [General Counsel of the County Judges and Commissioners] to ask if for an interpretation. He said, 'yes, any time that you get a donation like that, you should have court establish a value to it.'"

Bellmyer stated that TxDOT established a value at $20 a cubic yard and he wanted to make it public record that if in the future a value to it would be needed, it's recorded.

Commissioner Bellmyer moved to that the surplus riprap donated from TxDOT be evaluated at $20 a cubic yard. Commissioner Metcalf seconded the motion and it carried with all in favor.

During Commissioners' Court Reports Commissioner McSwain announced that the auction for his Peterbilt Truck ended and the truck sold for $30,500.

The meeting adjourned at 11:13.

American Red Cross Month, 2026 Proclamation:

In March, we celebrate American Red Cross Month by honoring our neighbors who make its humanitarian mission possible in Shelby County. Every day, their acts of kindness change lives, bringing relief, comfort and hope when help can't wait. This compassionate spirit runs deep in our community, just as it has for 145 years through the American Red Cross.

Today, those who serve with the American Red Cross light the way during emergencies - whether it's delivering shelter, food and comfort after disasters; providing a safe, lifesaving blood supply for patients facing conditions like cancer treatments, childbirth complications and traumatic injuries; assisting military members, veterans and their families with 24/7 global support; or empowering individuals with skills like first aid and CPR that save lives.

These collective efforts are a powerful reminder that the strength of our community lies in our shared commitment to one another. As we mark Red Cross Month, let's celebrate our local heroes and resolve to continue lifting each other up, so no one faces an emergency alone

Now, Therefore We Commissioners Court of Shelby County by virtue of the authority vested in me by the laws of Shelby County and Texas do hereby proclaim March 2026 as Red Cross Month. I encourage all citizens of Shelby County to reach out and support its humanitarian mission.

In Witness Whereof, I have hereunto set my hand this 4th day of March, in the year of our Lord two thousand twenty-six, and of the Shelby County Texas

Agenda items approved during the meeting include: 1. Pay weekly expenses. 2. Ratify the current Burn Ban. 3. Proclamation declaring the month of March as American Red Cross Month. 4. Designate DETCOG, on behalf of Shelby County, to verify addresses online. 5. Not to allow TxDOT to close a section of FM 139 at Paul’s Creek to replace the existing bridge. 6. Establish the value of TXDOT surplus rip contributed to all precincts of the County at $20 a cubic foot. 7. Appoint Rowdy Green to Constable Precinct 4. 8. Adjourn 11:13am.

March 4, 2026 - Due to a leak on the main, the Texas Commission on Environmental Quality has required the FIVE WAY Water system, ID# 2100008 to notify customers that were without water March 4, 2026 on CR 3051, 3054, and 3057 anyone without water) to boil their water, prior to consumption (e.g., washing hands/face, brushing teeth, drinking, etc). Children, seniors, and persons with weakened immune systems are particularly vulnerable to harmful bacteria, and all customers should follow these directions.

To ensure destruction of all harmful bacteria and other microbes, water for drinking, cooking, and ice making should be boiled and cooled prior to use for drinking water or human consumption purposes. The water should be brought to a vigorous rolling boil and then boiled for two minutes.

In lieu of boiling, individuals may purchase bottled water or obtain water from some other suitable source for drinking water or human consumption purposes.

When it is no longer necessary to boil the water, the public water system officials will notify customers that the water is safe for drinking water or human consumption purposes.

Once the boil water notice is no longer in effect, the public water system will issue a notice to customers that rescinds the boil water notice in a manner similar to this notice.

Please share this information with all the other people who drink this water, especially those who may not have received this notice directly (for example, people in apartments, nursing homes, schools, and businesses). You can do this by posting this notice in a public place or distributing copies by hand or mail.

If you have questions concerning this matter, you may contact Matt Di Verdi 936-591-4346.

March 4, 2026 - Law enforcement officers engaged in a pursuit on Tuesday, March 3, 2026, after a white 2008 Chevrolet Silverado 1500 pickup truck allegedly failed to stop when a Center Police Department unit attempted a traffic stop at around 2pm.

Officers traveled south on State Highway 87 South from Center to Shelbyville, and were seen on CR 2110 where the pursuit deviated from the main highway for a brief time before returning to SH 87 and heading south once again.

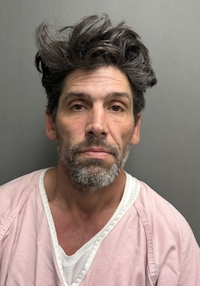

Ricardo Reyes

The pursuit traveled around 20 miles south of SL 500 in Center before turning onto CR 2156, and law enforcement officers have confirmed it traveled to the end of the roadway and drove through the entrance gate to a property before continuing approximately 100 yards to the front of a house where it drove through a fence and came to rest.

There officers continued pursuit of the driver on foot and placed the driver in custody.

Center Police Officers arrested Ricardo Reyes, 21, of Shelbyville and he was placed in the Shelby County Jail on charges of evading arrest/detention with a vehicle, felony 3; possession of a controlled substance PG 2 >=4G<400G, felony 2; tamper/fabricate evidence with intent to impair, felony 3; evading arrest/detention, misdemeanor a; and reckless driving, misdemeanor b.

Agencies participating in the pursuit include the Center Police Department, Texas Department of Public Safety, and Shelby County Sheriff’s Department.

March 3, 2026 - The March Primary Elections are over and unofficial results are in.

Editor's note: Results are unofficial until they have been ratified.

Results below are in order of:

- County Elections (Democrat, Republican)

- Democrat Federal and State results

- Republican Federal and State results

DEMOCRATIC PARTY

| COUNTY COMMISSIONER, PCT. 4 |

| Kevin Foster -- 100% (Unopposed) |

| Absentee 3 | Early 45 | Election Day 100 | TOTAL 148 |

| COUNTY CHAIR |

| Patsy Handy -- 100% (Unopposed) |

| Absentee 21 | Early 326 | Election Day 219 | TOTAL 566 |

REPUBLICAN PARTY

| COUNTY JUDGE |

| Allison Harbison -- 100% (Unopposed) |

| Absentee 78 | Early 1,266 | Election Day 1,518 | TOTAL 2,862 |

| DISTRICT CLERK |

| Karen May Matthews -- 55.0% |

| Absentee 45 | Early 787 | Election Day 990 | TOTAL 1,822 |

| Dee Dee Green -- 45.0% |

| Absentee 35 | Early 674 | Election Day 784 | TOTAL 1,493 |

| COUNTY CLERK |

| Jennifer Fountain -- 100% (Unopposed) |

| Absentee 76 | Early 1,237 | Election Day 1,493 | TOTAL 2,806 |

| COUNTY TREASURER |

| Ann Blackwell -- 100% (Unopposed) |

| Absentee 72 | Early 1,212 | Election Day 1,462 | TOTAL 2,746 |

| COMMISSIONER PRECINCT 2 |

| Shannon Metcalf -- 100% (Unopposed) |

| Absentee 18 | Early 283 | Election Day 323 | TOTAL 624 |

| COMMISSIONER PRECINCT 4 |

| Larry Molloy -- 50.5% |

| Absentee 8 | Early 128 | Election Day 247 | TOTAL 383 |

| William "Lum" Edwards -- 49.5% |

| Absentee 8 | Early 100 | Election Day 268 | TOTAL 376 |

| JUSTICE OF THE PEACE PRECINCT 1 |

| Donna Hughes -- 85.9% |

| Absentee 42 | Early 748 | Election Day 527 | TOTAL 1,317 |

| Andy Williams -- 14.1% |

| Absentee 6 | Early 110 | Election Day 100 | TOTAL 216 |

| JUSTICE OF THE PEACE PRECINCT 2 |

| Marla Denby -- 76.3% |

| Absentee 10 | Early 184 | Election Day 275 | TOTAL 469 |

| Roy H Bailey -- 23.7% |

| Absentee 2 | Early 68 | Election Day 76 | TOTAL 146 |

| JUSTICE OF THE PEACE PRECINCT 3 |

| Melba Rodgers -- 100% (Unopposed) |

| Absentee 5 | Early 165 | Election Day 311 | TOTAL 481 |

| JUSTICE OF THE PEACE PRECINCT 4 |

| Robert Barton -- 100% (Unopposed) |

| Absentee 5 | Early 53 | Election Day 109 | TOTAL 167 |

| JUSTICE OF THE PEACE PRECINCT 5 |

| Tracy Broadway -- 100% (Unopposed) |

| Absentee 10 | Early 101 | Election Day 300 | TOTAL 411 |

| COUNTY CONSTABLE PRECINCT 5 (UNEXPIRED TERM) |

| John Pope -- 100% (Unopposed) |

| Absentee 10 | Early 96 | Election Day 293 | TOTAL 399 |

| COUNTY CHAIR |

| Leigh Porterfield -- 100% (Unopposed) |

| Absentee 71 | Early 1,190 | Election Day 1,442 | TOTAL 2,703 |

DEMOCRAT FEDERAL AND STATE RESULTS

Democrat Ballot Election statistics

Registered Voters (Total) - 0

Ballots Cast (Total) - 0 -- 0% voter turnout

Democrat Party (Total) - 0

| UNITED STATES SENATOR |

| Ahmad R. Hassan |

| Absentee 1 | Early 3 | Election Day 9 | TOTAL 13 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| James Talarico |

| Absentee 5 | Early 124 | Election Day 56 | TOTAL 185 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| Jasmine Crockett |

| Absentee 19 | Early 283 | Election Day 232 | TOTAL 534 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| UNITED STATES REPRESENTATIVE, DISTRICT 1 (DEM) |

| Tracy Andrus |

| Absentee 6 | Early 84 | Election Day 48 | TOTAL 138 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| TMasika Akilah Ray |

| Absentee 3 | Early 61 | Election Day 36 | TOTAL 100 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| Dax Alexander |

| Absentee 3 | Early 68 | Election Day 41 | TOTAL 112 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| Yolanda R. Prince |

| Absentee 10 | Early 143 | Election Day 111 | TOTAL 264 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| GOVERNOR (DEM) |

| Carlton W. Hart |

| Absentee 3 | Early 24 | Election Day 25 | TOTAL 52 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| Jose Navarro Balbuena |

| Absentee 0 | Early 16 | Election Day 14 | TOTAL 30 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| Chris Bell |

| Absentee 1 | Early 75 | Election Day 65 | TOTAL 141 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| Andrew White |

| Absentee 2 | Early 19 | Election Day 17 | TOTAL 38 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| Gina Hinojosa |

| Absentee 12 | Early 164 | Election Day 70 | TOTAL 246 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| Zach Vance |

| Absentee 1 | Early 4 | Election Day 7 | TOTAL 12 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| Angela "Tiaangie" Villescaz |

| Absentee 0 | Early 28 | Election Day 23 | TOTAL 51 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| Patricia Abrego |

| Absentee 1 | Early 9 | Election Day 4 | TOTAL 14 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| Bobby Cole |

| Absentee 2 | Early 43 | Election Day 23 | TOTAL 68 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| LIEUTENANT GOVERNOR (DEM) |

| Marcos Isaias Velez |

| Absentee 5 | Early 105 | Election Day 76 | TOTAL 186 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| Vikki Goodwin |

| Absentee 13 | Early 205 | Election Day 123 | TOTAL 341 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| Courtney Head |

| Absentee 5 | Early 59 | Election Day 42 | TOTAL 106 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| ATTORNEY GENERAL (DEM) |

| Joe Jaworski |

| Absentee 7 | Early 85 | Election Day 55 | TOTAL 147 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| Anthony "Tony" Box |

| Absentee 5 | Early 90 | Election Day 47 | TOTAL 142 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| Nathan Johnson |

| Absentee 11 | Early 189 | Election Day 136 | TOTAL 336 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| COMPTROLLER OF PUBLIC ACCOUNTS (DEM) |

| Sarah Eckhardt |

| Absentee 16 | Early 211 | Election Day 117 | TOTAL 344 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| Michael Lange |

| Absentee 4 | Early 72 | Election Day 45 | TOTAL 121 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| Savant Moore |

| Absentee 3 | Early 75 | Election Day 70 | TOTAL 148 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| COMMISSIONER OF THE GENERAL LAND OFFICE (DEM) |

| Jose Loya |

| Absentee 14 | Early 160 | Election Day 85 | TOTAL 259 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| Benjamin Flores |

| Absentee 10 | Early 193 | Election Day 143 | TOTAL 346 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| COMMISSIONER OF AGRICULTURE (DEM) |

| Clayton Tucker |

| Absentee 21 | Early 312 | Election Day 207 | TOTAL 540 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| RAILROAD COMMISSIONER (DEM) |

| Jon Rosenthal |

| Absentee 21 | Early 318 | Election Day 206 | TOTAL 545 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| CHIEF JUSTICE, SUPREME COURT (DEM) |

| Maggie Ellis |

| Absentee 18 | Early 280 | Election Day 159 | TOTAL 457 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| Cory L. Carlyle |

| Absentee 5 | Early 73 | Election Day 67 | TOTAL 145 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| JUSTICE, SUPREME COURT, PLACE 2 (Unexpired Term) (DEM) |

| Chari Kelly |

| Absentee 20 | Early 309 | Election Day 205 | TOTAL 534 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| JUSTICE, SUPREME COURT, PLACE 7 (DEM) |

| Gordon Goodman |

| Absentee 9 | Early 100 | Election Day 79 | TOTAL 188 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| Kristen Hawkins |

| Absentee 14 | Early 251 | Election Day 147 | TOTAL 412 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| JUSTICE, SUPREME COURT, PLACE 8 (DEM) |

| Gisela D. Triana |

| Absentee 19 | Early 315 | Election Day 199 | TOTAL 533 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| JUDGE, COURT OF CRIMINAL APPEALS, PLACE 3 (DEM) |

| Okey Anyiam |

| Absentee 18 | Early 309 | Election Day 202 | TOTAL 529 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| JUDGE, COURT OF CRIMINAL APPEALS, PLACE 4 (DEM) |

| Audra Riley |

| Absentee 20 | Early 314 | Election Day 214 | TOTAL 548 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| JUDGE, COURT OF CRIMINAL APPEALS, PLACE 9 (DEM) |

| Holly Taylor |

| Absentee 21 | Early 317 | Election Day 206 | TOTAL 544 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| MEMBER, STATE BOARD OF EDUCATION, DISTRICT 9 (DEM) |

| Ericka Ledferd |

| Absentee 21 | Early 314 | Election Day 209 | TOTAL 544 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| STATE SENATOR, DISTRICT 3 (DEM) |

| Bobby Tillman |

| Absentee 20 | Early 310 | Election Day 210 | TOTAL 540 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| STATE REPRESENTATIVE, DISTRICT 11 (DEM) |

| Roxanne Lathan |

| Absentee 20 | Early 325 | Election Day 209 | TOTAL 554 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| CHIEF JUSTICE, 15TH COURT OF APPEALS DISTRICT (DEM) |

| Jerry Zimmerer |

| Absentee 20 | Early 316 | Election Day 197 | TOTAL 533 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| JUSTICE, 15TH COURT OF APPEALS DISTRICT, PLACE 2 (DEM) |

| Tom Baker |

| Absentee 20 | Early 315 | Election Day 203 | TOTAL 538 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| JUSTICE, 15TH COURT OF APPEALS DISTRICT, PLACE 3 (DEM) |

| Marc M. Meyer |

| Absentee 20 | Early 310 | Election Day 196 | TOTAL 526 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

REPUBLICAN FEDERAL AND STATE RESULTS

Republican Ballot Election statistics

Registered Voters (Total) - 0

Ballots Cast (Total) - 0 -- 0% voter turnout

Republican Party (Total) - 0

| UNITED STATES SENATOR (REP) |

| Ken Paxton |

| Absentee 38 | Early 772 | Election Day 928 | TOTAL 1,738 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| John Cornyn |

| Absentee 45 | Early 479 | Election Day 597 | TOTAL 1,121 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| Wesley Hunt |

| Absentee 6 | Early 187 | Election Day 217 | TOTAL 410 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| Anna Bender |

| Absentee 1 | Early 13 | Election Day 17 | TOTAL 31 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| John O. Adefope |

| Absentee 0 | Early 1 | Election Day 3 | TOTAL 4 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| Virgil John Bierschwale |

| Absentee 0 | Early 2 | Election Day 3 | TOTAL 5 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| Gulrez "Gus" Khan |

| Absentee 0 | Early 2 | Election Day 4 | TOTAL 6 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| Sara Canady |

| Absentee 1 | Early 11 | Election Day 16 | TOTAL 28 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| UNITED STATES REPRESENTATIVE, DISTRICT 1 (REP) |

| Nathaniel Moran |

| Absentee 55 | Early 1,078 | Election Day 1,285 | TOTAL 2,418 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| GOVERNOR (REP) |

| Ronnie Tullos |

| Absentee 1 | Early 13 | Election Day 15 | TOTAL 29 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| Greg Abbott |

| Absentee 87 | Early 1,276 | Election Day 1,569 | TOTAL 2,932 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| R.F. "Bob" Achgill |

| Absentee 0 | Early 4 | Election Day 4 | TOTAL 8 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| Evelyn Brooks |

| Absentee 1 | Early 17 | Election Day 19 | TOTAL 37 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| Mark V. Goloby |

| Absentee 0 | Early 4 | Election Day 0 | TOTAL 4 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| Stephen Samuelson |

| Absentee 0 | Early 6 | Election Day 8 | TOTAL 14 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| Arturo Espinosa |

| Absentee 0 | Early 4 | Election Day 9 | TOTAL 13 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| Nathaniel Welch |

| Absentee 0 | Early 3 | Election Day 2 | TOTAL 5 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| Pete "Doc" Chambers |

| Absentee 5 | Early 140 | Election Day 166 | TOTAL 311 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| Kenneth Hyde |

| Absentee 1 | Early 1 | Election Day 2 | TOTAL 4 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| Charles Andrew Crouch |

| Absentee 1 | Early 15 | Election Day 13 | TOTAL 29 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| LIEUTENANT GOVERNOR (REP) |

| Perla Muñoz Hopkins |

| Absentee 2 | Early 47 | Election Day 54 | TOTAL 103 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| Timothy Mabry |

| Absentee 7 | Early 124 | Election Day 128 | TOTAL 259 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| Dan Patrick |

| Absentee 81 | Early 1,237 | Election Day 1,511 | TOTAL 2,829 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| Esala Wueschner |

| Absentee 0 | Early 11 | Election Day 19 | TOTAL 30 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| ATTORNEY GENERAL (REP) |

| Mayes Middleton |

| Absentee 35 | Early 474 | Election Day 662 | TOTAL 1,171 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| Joan Huffman |

| Absentee 17 | Early 333 | Election Day 432 | TOTAL 782 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| Aaron Reitz |

| Absentee 7 | Early 146 | Election Day 129 | TOTAL 282 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| Chip Roy |

| Absentee 30 | Early 416 | Election Day 429 | TOTAL 875 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| COMPTROLLER OF PUBLIC ACCOUNTS (REP) |

| Kelly Hancock |

| Absentee 26 | Early 384 | Election Day 477 | TOTAL 887 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| Christi Craddick |

| Absentee 20 | Early 354 | Election Day 345 | TOTAL 719 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| Don Huffines |

| Absentee 36 | Early 602 | Election Day 818 | TOTAL 1,456 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| Michael Berlanga |

| Absentee 0 | Early 35 | Election Day 27 | TOTAL 62 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| COMMISSIONER OF THE GENERAL LAND OFFICE (REP) |

| Dawn Buckingham |

| Absentee 64 | Early 1,097 | Election Day 1,317 | TOTAL 2,478 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| COMMISSIONER OF AGRICULTURE (REP) |

| Sid Miller |

| Absentee 42 | Early 850 | Election Day 995 | TOTAL 1,887 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| Nate Sheets |

| Absentee 28 | Early 505 | Election Day 657 | TOTAL 1,190 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| RAILROAD COMMISSIONER (REP) |

| Katherine Culbert |

| Absentee 5 | Early 131 | Election Day 163 | TOTAL 299 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| Jim Wright |

| Absentee 36 | Early 445 | Election Day 475 | TOTAL 956 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| Hawk Dunlap |

| Absentee 7 | Early 270 | Election Day 375 | TOTAL 652 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| James (Jim) Matlock |

| Absentee 12 | Early 267 | Election Day 252 | TOTAL 531 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| Bo French |

| Absentee 17 | Early 234 | Election Day 361 | TOTAL 612 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| CHIEF JUSTICE, SUPREME COURT (REP) |

| Jimmy Blacklock |

| Absentee 67 | Early 1,130 | Election Day 1,410 | TOTAL 2,607 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| JUSTICE, SUPREME COURT, PLACE 2 (Unexpired Term) (REP) |

| James P. Sullivan |

| Absentee 68 | Early 1,122 | Election Day 1,394 | TOTAL 2,584 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| JUSTICE, SUPREME COURT, PLACE 7 (REP) |

| Kyle Hawkins |

| Absentee 67 | Early 1,115 | Election Day 1,401 | TOTAL 2,583 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| JUSTICE, SUPREME COURT, PLACE 8 (REP) |

| Brett Busby |

| Absentee 67 | Early 1,118 | Election Day 1,399 | TOTAL 2,584 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| JUDGE, COURT OF CRIMINAL APPEALS, PLACE 3 (REP) |

| Lesli Fitzpatrick |

| Absentee 16 | Early 263 | Election Day 314 | TOTAL 593 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| Brent Coffee |

| Absentee 14 | Early 295 | Election Day 404 | TOTAL 713 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| Thomas Smith |

| Absentee 31 | Early 353 | Election Day 457 | TOTAL 841 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| Alison Fox |

| Absentee 9 | Early 216 | Election Day 212 | TOTAL 437 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| JUDGE, COURT OF CRIMINAL APPEALS, PLACE 4 (REP) |

| Kevin Patrick Yeary |

| Absentee 68 | Early 1,068 | Election Day 1,332 | TOTAL 2,468 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| JUDGE, COURT OF CRIMINAL APPEALS, PLACE 9 (REP) |

| Jennifer Balido |

| Absentee 26 | Early 322 | Election Day 357 | TOTAL 705 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| John Messinger |

| Absentee 45 | Early 805 | Election Day 1,020 | TOTAL 1,870 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| MEMBER, STATE BOARD OF EDUCATION, DISTRICT 9 (REP) |

| Rachel Hogue |

| Absentee 33 | Early 410 | Election Day 496 | TOTAL 939 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| Stephen Yearout |

| Absentee 6 | Early 173 | Election Day 179 | TOTAL 358 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| Kason Huddleston |

| Absentee 31 | Early 562 | Election Day 749 | TOTAL 1,342 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| STATE SENATOR, DISTRICT 3 (REP) |

| Rhonda Ward |

| Absentee 23 | Early 555 | Election Day 783 | TOTAL 1,361 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| Trent Ashby |

| Absentee 62 | Early 888 | Election Day 985 | TOTAL 1,935 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| STATE REPRESENTATIVE, DISTRICT 11 (REP) |

| Joanne Shofner |

| Absentee 66 | Early 1,142 | Election Day 1,401 | TOTAL 2,609 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| CHIEF JUSTICE, 15TH COURT OF APPEALS DISTRICT (REP) |

| Scott Brister |

| Absentee 66 | Early 1,088 | Election Day 1,363 | TOTAL 2,517 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| JUSTICE, 15TH COURT OF APPEALS DISTRICT, PLACE 2 (REP) |

| Scott K. Field |

| Absentee 67 | Early 1,089 | Election Day 1,363 | TOTAL 2,519 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| JUSTICE, 15TH COURT OF APPEALS DISTRICT, PLACE 3 (REP) |

| April Farris |

| Absentee 60 | Early 1,089 | Election Day 1,370 | TOTAL 2,519 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| CHIEF JUSTICE, 12TH COURT OF APPEALS DISTRICT (DEM) |

| Brian Hoyle |

| Absentee 67 | Early 1,082 | Election Day 1,349 | TOTAL 2,498 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| JUSTICE, 12TH COURT OF APPEALS DISTRICT, PLACE 3 (REP) |

| Michael Davis |

| Absentee 68 | Early 1,080 | Election Day 1,344 | TOTAL 2,492 |

| STATEWIDE Percentage 0% | TOTAL VOTES 0 |

| DISTRICT JUDGE, 273RD JUDICIAL DISTRICT (REP) |

| James A. ("Jim") Payne, Jr. |

| Absentee 73 | Early 1,174 | Election Day 1,396 | TOTAL 2,643 |

February 17, 2026 - Early voting in the 2026 March 3rd Primary Elections began at 7am on Tuesday, February 17, 2026. Links to sample ballots, polling locations, and early voting schedule are below.

March 2, 2026 - Due to a leak on the main, the Texas Commission on Environmental Quality has required the FIVE WAY Water system, ID# 2100008 to notify customers that were without water March 2, 2026 from James community toward Center all county roads off of HWY 7 and 699 area (anyone without water) to boil their water, prior to consumption (e.g., washing hands/face, brushing teeth, drinking, etc). Children, seniors, and persons with weakened immune systems are particularly vulnerable to harmful bacteria, and all customers should follow these directions.

To ensure destruction of all harmful bacteria and other microbes, water for drinking, cooking, and ice making should be boiled and cooled prior to use for drinking water or human consumption purposes. The water should be brought to a vigorous rolling boil and then boiled for two minutes.

In lieu of boiling, individuals may purchase bottled water or obtain water from some other suitable source for drinking water or human consumption purposes.

When it is no longer necessary to boil the water, the public water system officials will notify customers that the water is safe for drinking water or human consumption purposes.

Once the boil water notice is no longer in effect, the public water system will issue a notice to customers that rescinds the boil water notice in a manner similar to this notice.

Please share this information with all the other people who drink this water, especially those who may not have received this notice directly (for example, people in apartments, nursing homes, schools, and businesses). You can do this by posting this notice in a public place or distributing copies by hand or mail.

If you have questions concerning this matter, you may contact Matt Di Verdi 936-591-4346.

March 2, 2026 - Commissioner PCT 2 has announced that will be a scheduled control burn in the area of Patroon and East Liberty (CR 2865) today Monday, March 2nd. The scheduled burn should begin around 10:30am and continue throughout the day. Please use caution if you should be traveling within this area today.

Editor's Note: The county is still currently under a burn ban. While burn bans restrict debris burning, prescribed or controlled burns (used for land management) are often exempt if conducted under specific, safe guidelines and registered with the Texas A&M Forest Service.

February 28, 2026 - The Texas Commission on Environmental Quality required the City of Center public water system, Tx2100001, to issue a Boil Water Notice on February 26, 2026, to inform customers, individuals, or employees that due to conditions which occurred recently in the public water system, the water from this public water system was required to be boiled prior to use for drinking water or human consumption purposes.

The public water system has taken the necessary corrective actions to restore the quality of the water distributed by this public water system used for drinking water or human consumption purposes and has provided TCEQ with laboratory test results that indicate that the water no longer requires boiling prior to use as of 2/28/2026.

If you have questions concerning this matter, you may contact City Hall at 936-598-2941.

February 26, 2026 - Due to loss of water pressure throughout the system from major leak on transmission line, the Texas Commission on Environmental Quality has required the City of Center / TX2100001 public water system to notify all customers to boil their water prior to consumption (e.g., washing hands/face, brushing teeth, drinking, etc). Children, seniors, and persons with weakened immune systems are particularly vulnerable to harmful bacteria, and all customers should follow these directions).

To ensure destruction of all harmful bacteria and other microbes, water for drinking, cooking, and ice making should be boiled and cooled prior to use for drinking water or human consumption purposes. The water should be brought to a vigorous rolling boil and then boiled for two minutes.

In lieu of boiling, individuals may purchase bottled water or obtain water from some other suitable source for drinking water or human consumption purposes.

When it is no longer necessary to boil the water, the public water system officials will notify customers that the water is safe for drinking water or human consumption purposes.

Once the boil water notice is no longer in effect, the public water system will issue a notice to customers that rescinds the boil water notice in a manner similar to this notice.

Please share this information with all the other people who drink this water, especially those who may not have received this notice directly (for example, people in apartments, nursing homes, schools, and businesses). You can do this by posting this notice in a public place or distributing copies by hand or mail.

If you have questions concerning this matter, you may contact City Hall at 936-598-2941.

Debido a la pérdida de presión de agua en todo el sistema por una fuga importante en la línea de transmisión la Comisión de Calidad Ambiental de Texas ha requerido que el sistema público de agua City of Center / TX2100001 notifique a todos los clientes que hiervan el agua antes del consumo (p. ej., lavarse la cara y las manos, cepillarse los dientes, beber, etc.). Los niños, las personas mayores y las personas con un sistema inmunológico debilitado son particularmente vulnerables a bacterias dañinas y todos los clientes deberían seguir estas instrucciones.

Para asegurar la destrucción de todas las bacterias y otros microbios dañinos, el agua para beber, cocinar y hacer hielo debe ser hervida (y enfriada) antes de su uso como agua potable o para otros fines de consumo humano. El agua debe llevarse a una ebullición vigorosa y luego hervirse por dos minutos.

En lugar de hervir, las personas pueden comprar agua embotellada u obtener agua de alguna otra fuente adecuada para beber u otros fines de consumo humano.

Cuando ya no sea necesario hervir el agua, los funcionarios del sistema público de agua notificarán a los clientes que el agua es segura para beber u otros fines de consumo humano.

Una vez que el aviso de hervir el agua ya no esté en vigencia, el sistema público de agua emitirá un aviso a sus clientes rescindiendo el aviso de hervir el agua en una manera parecida al presente aviso.

Sírvase compartir esta información con todas las otras personas que beben esta agua, especialmente aquellas que quizás no hayan recibido este aviso directamente (por ejemplo, personas en departamentos, hogares de ancianos, escuelas y negocios). Puede hacerlo colgando este aviso en un lugar público o repartiendo copias a mano o por correo.

Si usted tiene preguntas sobre este asunto, puede contactar a City Hall en 936-598-2941.

February 27, 2026 - A man has been arrested following at least two reported disturbances in Shelby County alleged to have occurred on Thursday, February 26, 2026.

The Shelby County Sheriff’s Office has confirmed the occurrence and that the individual Robert Rodriguez Villarreal, Jr., 45, of Dennison was arrested in Sabine County following his alleged actions in Shelby County.

According to Shelby County Sheriff Chief Deputy Mike Hanson, Shelby County Dispatch was contacted around 2:45pm when Despino’s Tire reported Villarreal was acting strangely as he entered and left the shop several times and they were concerned he had ill intentions. Villarreal left and traveled to a house on CR 1024 where he allegedly gained entry and stole a pistol. Once discovered by the homeowner, Villarreal allegedly pointed the weapon at the homeowner before eventually leaving the residence and leaving the firearm behind.

According to Chief Hanson, as agencies in Shelby County were working to determine the positive identity of Villarreal they learned of a situation in Sabine County involving an individual matching their suspect who was attempting to enter a residence there.

Villarreal was later discovered in Sabine County at a residence on U.S. Highway 96 near the San Augustine County line.

Sabine County Chief Deputy JP McDonough advised they received a call of a suspicious person off Rayburn Ridge in the southwestern corner of Sabine County right off of Lake Rayburn. A homeowner contacted the Sabine County Sheriff’s Department in reference to his home security camera capturing an individual trying doors on the house to see if they were unlocked. The homeowner contacted a neighbor, who was also a retired Texas Department of Public Safety State Trooper who then engaged Villarreal in an argument which kept busy until a number of deputies arrived and took Villarreal into custody.

Robert Rodriguez Villarreal, Jr. is being held in the Sabine County Jail on a parole warrant with no bond; fail to identify false/fictitious information, $10,000 surety bond; criminal trespass, $7,500 surety bond.

Several felonies are anticipated to be filed in Shelby County.