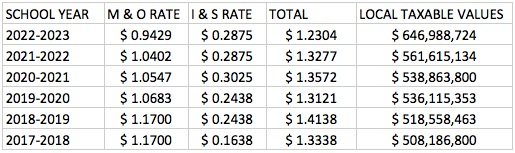

October 20, 2022 - It has come to the attention of the Center Independent School District that there is a rumor that the passing of the recent bond is the reason that property taxes have gone up. We wanted to assure you that this is not the case. The school district can only set the tax rate. We have no control over local property value assignments. For instance, for the 2022-2023 school year our M&O Tax rate dropped by almost a dime from the 2021-2022 school year. However, the State Comptroller’s office has forced the increase in property values across the State, which is what caused property owner’s taxes to increase. I am including a chart with historical information for Center ISD.

Thank you, Dr. Brian Morris Superintendent Center ISD

Editor Note:

For a more information regarding property taxes, visit https://shelby.truthintaxation.com/property-search.

In April 2022, the Shelby County Appraisal District notified property owners they would see an increase in valuations for the year. To read the press release, click here. For homeowners needing assistance for delinquent property taxes, click here for more information.